Making it a strong option for margin traders seeking to remain credit will cost you off. Add in fractional share exchange, and this lets you begin using that have only $step 1, and you will Robinhood is actually a powerful come across to own costs-conscious investors searching for a person-friendly platform. Your finances is so covered but merely from the impractical feel a brokerage otherwise money company fails. SIPC insurance rates hides to help you $500,100000 to own destroyed otherwise forgotten assets; within one, $250,100000 applies in order to dollars that isn’t but really spent. What it does not protection is a loss in the worth of the assets.

How do i Open a trading and investing Account?

Charles Schwab requires the new top since the #1 Total Representative away from 2025, and for justification — it’s got a tailored solution for every type of buyer, it doesn’t matter the sense height otherwise investment desires. Of scholar https://www.dylaniumknits.com/migliori-corsi-di-trading-online-2025-a-scrocco-ovvero-interessato/ buyers so you can productive traders, Schwab doesn’t merely render a top-top respond to; they brings a solution tailored especially for your circumstances. An element of the issues up against SogoTrade relate to the trade platforms, and that some users discover complicated and without enhanced functions. Some profiles in addition to note a bad user experience in terms to research. However, benefits are an easy membership-beginning procedure and you will multilingual customer service.

- We’ve analyzed for each and every agent on the pros and cons, this is when’s the way they pile up on the most important issues.

- Beyond the $0 stock and you will ETF profits, Entertaining Brokers stands out for its reduced margin prices, that are extremely competitive we have analyzed.

- Anybody else can get cutting-edge products which can be beneficial to constant investors and those who are interested in more complicated devices including options and you may futures.

- Begin by a little bit of currency, comprehend using instructions, and maintain simple to use by buying and you may carrying to the enough time term as opposed to seeking to day the marketplace.

- To compare our gathered investigation side by side, below are a few all of our on line agent evaluation tool.

Undertaking a listing of your own using wants will allow you to thin down the options and acquire the ideal brokerage to your requirements. Very own a piece of the favourite companies and replace-replaced financing (ETFs) for only $step one.00. Benefit from all of our complete look and you can low on the web percentage rates to buy market offers out of in public places exchanged organizations both in domestic and you can worldwide locations.

As to why exchange carries having Fidelity?

You can purchase become investing by the beginning a broker membership, transferring money through the trade program, and ultizing your deposit to find market brings. Some need in initial deposit up on beginning, and you may utilize this put to help you change. Understanding the largest and you may quickest-broadening broker firms is essential whenever choosing the proper platform to have your own investments. Firms including Charles Schwab, Leading edge, and Fidelity lead the market that have trillions within the property and you may millions out of active accounts, offering balances and you may a general set of features. To own traders seeking to accuracy, these types of really-founded agents provide a powerful basis.

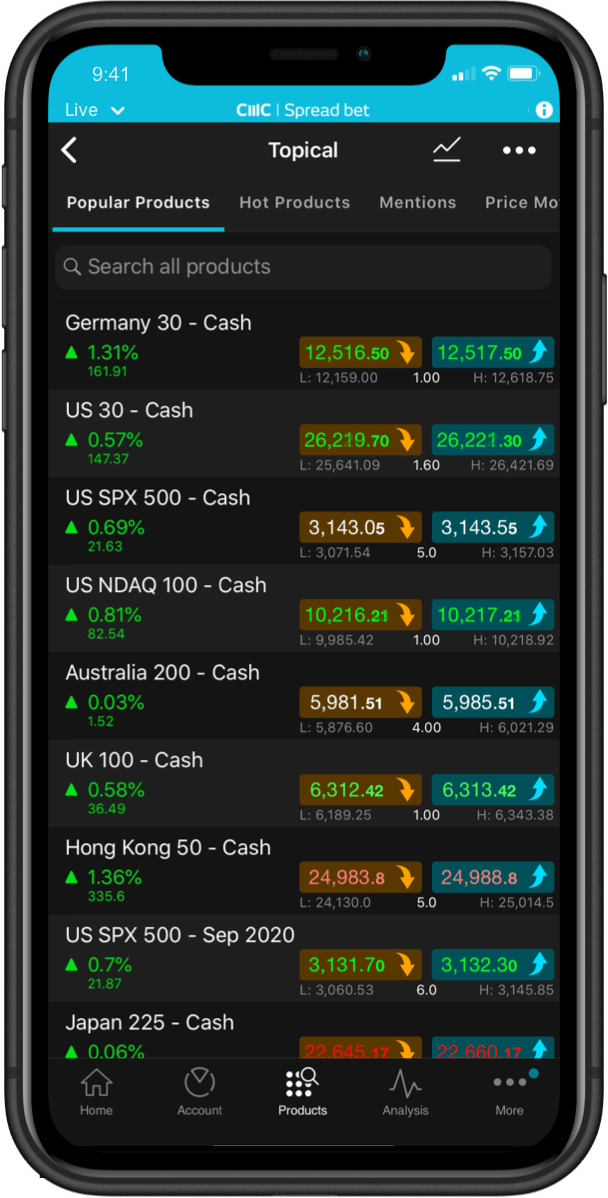

So if you’re an expert, ensure that the broker you decide on contains the products to keep up with you. Dollars accounts accommodate change just with dollars, meaning to buy energy need protection the full purchase price of each and every exchange. Traded financing is susceptible to an instantly paying down several months, so continues is going to be accessed quickly however instantly. Cash membership commonly subject to Development Day Investor (PDT) laws and regulations as long as unsettled money are not used in exchange. Trading profile offer investors usage of the brand new business information because the it takes place. They also get access to financial and you will search reports of the market leading companies, that helps consider its monetary efficiency and also the asked trend in the the future.

Margin Account

Finding the optimum stock broker tends to make or break the investing experience. Robinhood Locations Inc. (HOOD) developed no-payment stock, ETF, and you will possibilities change back into 2013, and more than on the internet brokers has as the used match. Robinhood makes profits away from fee to own buy move (PFOF), margin attention, income of bucks holdings, and a lot more. PFOF ‘s the payment an agent get to own directing investments to a certain business founder.

Exactly why are IBKR very popular with advanced people could be a drawback for cheap educated traders. A lot of the networks are aimed toward experienced buyers, support complex charting products and you will cutting-edge tech investigation. Very, you could find that there’s a lot more of an understanding bend when getting to grips with IBKR than just to the almost every other agents for the the list. Fidelity allows you to change fractional otherwise whole offers, mutual financing, ETFs, options, securities, cryptocurrency and a lot more. No lowest deposit demands and no commissions on the You.S. brings, ETFs or choices deals, it may be an installment-active option for college student people.

Academic Webinars and you will Situations

Trade in twenty five nations and you will 16 additional currencies to benefit from foreign exchange movement; availableness genuine-day business research to help you exchange at any time. Benefit from inventory monitor actions of independent third-party advantages to research carries, ETFs, and you may choices, otherwise build your own screens playing with more than 140 custom strain. Trade securities playing with a wealth of lookup and you will complex devices to the the easy to use trading web site. Understanding the difference between a fundamental brokerage account and you can an enthusiastic IRA can help you select whether or not you will want to discover one or the other—or both.

(When you’re a new comer to it, we’ve had you protected in our self-help guide to IRAs.) If you are investing to own a shorter-label goal, basically an agent account was best. Whether or not you have cautiously chosen investments, sluggish cash can begin to help you accrue in your brokerage membership out of activities like dividend repayments. Although the Federal Reserve has started to reduce rates of interest, overall prices are still higher — it nevertheless pays to consider what rate your brokerage firm will pay about this uninvested dollars. You may not have the ability to stop account fees completely, but you can indeed eliminate him or her. Extremely agents often charge you to possess animated away assets, or closing your account totally.