Posts

All june, mydeposits notices an increase in stop from tenancy items regarding outside areas, out of overgrown yards and you will inactive flowers so you can unauthorised structures and you may garden wreck. Comprehend the end of this guide to possess an entire summer property checklist that you can adjust and you can share with your renters. Enough time, warm nights often indicate tenants try experiencing the yard really on the the night time, either noisily. Remind renters becoming careful from neighbors, especially in common otherwise heavily inhabited parts. When you yourself have a good relationship with the brand new neighbours, think going for your own contact information in case music gets a keen issue. With college or university getaways and much more time invested exterior, golf ball games become more regular and will trigger accidental damage.

In which Should you decide File?

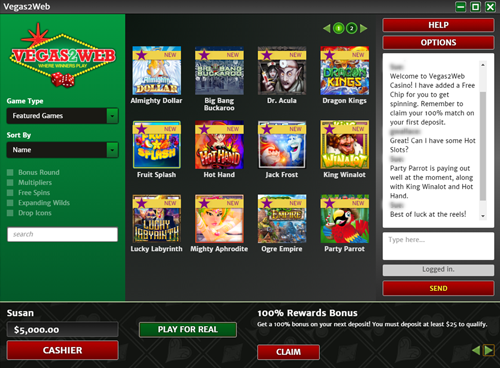

Looking for global popularity, the site welcomes dumps in the You Cash, Australian Cash, Canadian bucks, and even Bitcoin. As well, you can sidetrack regarding the regular game so you can BTC online game and you will have a field-day. We’ll complement to 1% of your auto deposits from the stop from August to $ten,000. All the auto deposits should be initiated and you may received by the end out of August. Advantages depends for the Online Vehicle Deposit Sections (discover table less than).

It is one of the most easy deals profile to utilize when all that’s necessary to do is create your money that have zero requirements connected. You might ready yourself the newest income tax go back oneself, see if your be eligible for free income tax planning, otherwise get a taxation professional to arrange your own come back. If you will document Function 1040-NR and you don’t discover wages while the an employee susceptible to U.S. taxation withholding, the newest recommendations to the worksheet is changed below. For every period, is projected taxation payments produced and people an excessive amount of social shelter and railway retirement tax. If you don’t discover your revenue equally throughout the year, your own required estimated tax money is almost certainly not a similar to own for each and every period.

Comments to your (Upgraded dos July Finest Singapore Fixed Put Costs and you may Discounts Profile

For individuals who get staff seasonally—including to have june or winter season just—see the field on the web 18. Examining the container says to the newest Internal revenue service not to ever assume four Models 941 away from you throughout the year as you have not casino Unibet review repaid earnings regularly. If you need much more in the-breadth details about payroll income tax subject areas in accordance with Mode 941, discover Bar. If you find a blunder to your a formerly filed Mode 941, or you if not must amend a previously filed Setting 941, result in the modification having fun with Setting 941-X. For more information, understand the Guidelines to have Form 941-X, point 13 out of Bar.

The fresh Taxpayer Recommend Provider (TAS) Is here now In order to

However, because the worksheets and you will withholding steps don’t be the cause of all the you can issues, you might not end up being obtaining the right amount withheld. Instead, complete Tips step three as a result of 4b for the Setting W-cuatro for the job. If you (or if hitched submitting as you, you and your spouse) lack work, over Actions step 3 thanks to 4b on the Form W-4P for the newest your retirement or annuity one to will pay probably the most a year.

For individuals who wear’t shell out sufficient income tax, either due to estimated tax otherwise withholding, otherwise a mixture of both, you may have to spend a penalty. The value of particular noncash fringe professionals you receive from your own employer is regarded as element of your earnings. Your boss need generally withhold tax within these advantages from your normal spend. Reimbursements and other debts allowances paid by the employer less than a good nonaccountable bundle is actually addressed since the supplemental earnings.

What is actually an expression deposit?

You can pertain extent to your Worksheet 1-5, range 5, to only you to employment otherwise separate they amongst the work one ways you wish. For each employment, determine the extra matter that you want to apply compared to that job and you may split one amount by the quantity of paydays leftover inside 2025 for that employment. This may give you the extra amount to enter into to your Setting W-4 you’ll declare one to employment.

NIIT is actually a good step three.8% income tax on the lower away from web financing earnings or the too much of your MAGI over $two hundred,one hundred thousand ($250,100 if the hitched processing jointly or qualifying enduring partner; $125,one hundred thousand if hitched filing on their own). The new sick pay will likely be provided on the internet 5a, line 5c, and you will, if your withholding threshold is actually satisfied, range 5d. Government legislation means your, because the a manager, to withhold specific taxation out of your employees’ pay. Each time you shell out wages, you need to keep back—and take from your own employees’ shell out—particular quantity to possess government income tax, public shelter income tax, and you can Medicare tax. You should along with withhold More Medicare Tax out of wages you have to pay to an employee over $200,100000 within the a twelve months. Under the withholding system, taxation withheld from the workers are paid for the group inside fee of their taxation obligations.

When you use their envelopes (rather than the brand new window envelope that is included with the new 1040-Parece package), make sure you send your own commission coupon codes to your address shown in the Function 1040-Es tips to the place in your geographical area. Investing on the net is easier and you will secure and assists make certain that i get the repayments promptly. To spend your taxes on line and for more info, see Internal revenue service.gov/Money. Money from U.S. income tax have to be remitted to your Internal revenue service in the U.S. dollars. When you are a recipient out of a home otherwise faith, and also the trustee elects in order to borrowing 2025 trust costs away from projected taxation to you, you could potentially lose extent paid while the paid from you to your January 15, 2026.

SANTA CLARITA, Calif., June 27, 2022 /PRNewswire/ — Which have a cruise vacation to package and look toward simply got easier. Promotion Several months begins Get 18, 2023 and you will closes August 30, 2023. To be eligible for the new campaign, an excellent being qualified associate’s account should be discover having qualifying deposit(s) acquired inside the Promotion Period.